Silver Bars

What to consider when buying silver bars?

Silver bars are subject to value-added tax at the rate of 20 percent. Taxation under the margin scheme is only possible for coins.

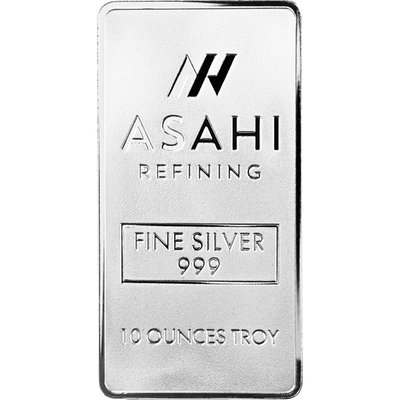

Silver bars can be uniquely identified by the casting mark and serial number.

Silver bars can be traded internationally.

When buying silver bars, it is recommended to make partial purchases as they can be sold flexibly.

Due to its lower density, the weight of purchased silver is greater compared to gold for the same amount invested.

Pay attention to the fineness. In Europe, the fineness of 999/1000 has become accepted, but in other countries it may vary.

Why invest in a silver bar?

Investing in precious metals is always recommended to diversify one's investment portfolio. Investing in silver bars is possible with a much smaller budget than investing in gold. One advantage of silver bars over silver coins is that when you buy a silver bar, you only pay the material value and a small processing fee, whereas with a coin you have to include the minting premium. Silver bars are easy to store in a space-saving way due to their rectangular shape.

How are silver bars made?

What to consider when storing silver?

Silver reacts only slightly or weakly with other substances. Silver is sensitive to hydrogen sulfide, which is present in the air and can trigger a chemical reaction. During the process, silver sulfides are formed, which are responsible for the black tarnishing of the precious metal. To avoid this discoloration, it is important to pay attention to the proper silver care and storage. Silver bars up to a size of 100 grams are packed in blister packs.

The blister packaging protects the bar from environmental influences, scratches, and other signs of wear. In addition, the silver bar is sealed airtight by the blister packaging, which is why discoloration of the precious metal is unlikely to occur. The resale value is significantly higher when the bar is pristine, without scratches and shiny. The attractiveness of the silver bar is also increased by an intact blister pack. Blister packaging not only protects the bar, but also provides adequate protection against counterfeiting. Although the blister packaging can be copied and counterfeited, it provides a barrier to counterfeiters because both the bar and the packaging must look convincingly genuine.

Interesting facts about silver

World-famous from the beginning

People have known and worked with silver since the 5th millennium BC. The Germanic tribes, Greeks, Romans, Egyptians, and Assyrians particularly appreciated the precious metal. Among the ancient Egyptians, silver was also known as the "moon metal." There were even times when silver was more valuable than gold. At that time, the white, shiny precious metal came from the mines in Laurion, near Athens.

Silver from the 6th century

In the Middle Ages and early modern times, silver was also discovered in Central Europe. Silver was found mainly in Germany, for example in the Harz or the Black Forest, but also in Slovakia. The largest silver producer at that time was in Austria, specifically in Schwaz, Tyrol. Approximately 80% of the silver deposits came from the tunnels of the Schwazer Knappen.

Silver substitute

Around the 16th century, the Spanish brought silver from Latin America to Europe. Japan also exported a lot of silver to the West, which meant that silver was no longer a rarity, but a precious metal frequently used in society. The law of supply and demand applies, resulting in a low silver price. In the following decades, the precious metal lost more importance and value and was often replaced by gold or steel.

The speculative bubble

In 1979, with the Hunt brothers, there was a turnaround. The price of silver rose by an incredible 435%, as the brothers had bought enormous amounts of silver and wanted to dominate the market on their own. At that point, the price was $32.20 per troy ounce. Just one year later, the price of silver had reached a record high of $49.45 per troy ounce (adjusted for inflation: $141.1). Because everyone wanted to own silver at this point, the COMEX commodity exchange issued a ban on silver purchases and increased security requirements. As the price of silver exceeded the actual value of the precious metal, the speculative bubble burst and the price fell to $4.81.

The industry

Silver has been used in industry since the beginning of the 21st century. In the last five years, silver demand from industry accounted for more than half of annual global demand. This in turn means that industry and economic growth strongly influence the price of silver. The precious metal is used in batteries, LED chips, solar energy, and in medicine, as silver has particularly good conductivity, is antibacterial, and is easy to process. The largest customers in the industry are the United States, Canada, China, India, Japan, South Korea, Germany and Russia.

Interesting Facts

Silver deposits

In 2021, 24,831 tons of silver were mined worldwide. The valuable metal is mined in North and South America, but also in China, Russia, and Australia. In 2009, Peru had the world's largest silver production, accounting for about 30 percent of global production. In 2020, Mexico led silver production with 5,600 tons, followed by Peru, China, Russia, Poland, Chile, Australia, and Bolivia.

Silver shines and conducts more

The precious white metal is the most lustrous element in the world when it is visible. Over 99% of light can be reflected by silver. Silver is therefore used in mirrors and microscopes. It also has the highest electrical conductivity and is therefore used in electronics, e.g., in telephones or light switches.